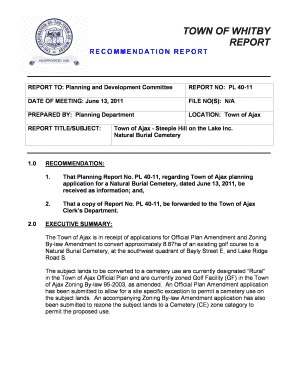

Zions Bank Wire Transfer Agreement 2011-2026 free printable template

Show details

WIRE TRANSFER AGREEMENT Customer This agreement between the Bank named above and the Customer and its authorized agents hereafter Customer governs origination and receipt of wire transfers on behalf of the Customer. Customer s obligations shall not be excused in these circumstances. The Bank shall reject any transfer request or incoming wire transfer which does not conform to the limitations security procedures and/or other requirements set forth in this agreement such as availability of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bank transfer agreement form

Edit your wire transfer template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your republic wire transfer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wire transfer form template online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wire transfer agreement sample form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wire agreement form

How to fill out Zions Bank Wire Transfer Agreement

01

Obtain the Zions Bank Wire Transfer Agreement form from the bank's website or a local branch.

02

Begin by filling out your personal information, including your name, address, and account number.

03

Specify the amount you wish to transfer and the currency type.

04

Provide the recipient's information, including their name, address, and bank account details.

05

Indicate the purpose of the transfer in the designated section.

06

Review any fees associated with the wire transfer.

07

Sign and date the agreement to authorize the transfer.

08

Submit the completed form to your local Zions Bank branch or through their online banking platform.

Who needs Zions Bank Wire Transfer Agreement?

01

Customers who want to send money to individuals or businesses outside their local banking network.

02

Individuals or businesses that require wire transfers for payments, invoicing, or business transactions.

03

Anyone who needs to make a secure and quick transfer of funds domestically or internationally.

Fill

zions bank international wire transfer

: Try Risk Free

People Also Ask about wells fargo wire transfer receipt

How do I fill out a bank wire transfer form?

To send a wire transfer, you need to visit your local branch and provide the following information about the recipient's account: Account holder name and full address. Account number. Branch number and full address. Institution number. Swift Code / BIC / IBAN code. Routing Number (international)

What is needed for a wire transfer between banks?

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

How do I wire money between two banks?

Steps for Transferring Money Between Banks Log into your bank's website or connect via the bank's app. Click on the transfer feature and choose transfer to another bank. Enter the routing and account numbers for the account at the other bank. Make the transfer.

Do banks have to report wire transfers?

Under the Bank Secrecy Act (BSA) of 1970, financial institutions are required to report certain transactions to the IRS. This includes wire transfers over $10,000, which are subject to reporting under the Currency and Foreign Transactions Reporting Act (31 U.S.C. 5311 et seq.).

Can you wire money between any 2 bank accounts?

You can transfer money to accounts you own at the same or different banks. Wire transfers and ACH transfers allow you to move money between your account and someone else's account, either at the same bank or at different banks. You can also transfer money to mobile payment apps or friends and family via those apps.

What is a wire transfer agreement?

A wire transfer agreement is a contract that establishes the terms of transferring funds from one party to another through an electronic wire system. Wire transfers are usually used for large payments or as part of a more significant, more complicated transaction such as buying and selling stocks.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wire transfer receipt in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your bank transfer form template and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the bank wire transfer slip form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign bank wire transfer form template. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit wire transfer form pdf on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign wells fargo wire transfer form pdf right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is Zions Bank Wire Transfer Agreement?

The Zions Bank Wire Transfer Agreement is a formal contract that outlines the terms and conditions for executing wire transfers through Zions Bank, including responsibilities and liabilities of the bank and the customer.

Who is required to file Zions Bank Wire Transfer Agreement?

Individuals or businesses that wish to initiate wire transfers through Zions Bank are required to file the Zions Bank Wire Transfer Agreement.

How to fill out Zions Bank Wire Transfer Agreement?

To fill out the Zions Bank Wire Transfer Agreement, you need to provide detailed information such as your personal or business information, the type of transfer, recipient details, and sign the agreement.

What is the purpose of Zions Bank Wire Transfer Agreement?

The purpose of the Zions Bank Wire Transfer Agreement is to establish the legal framework for wire transfers, ensuring that both the bank and the customer understand their rights and obligations.

What information must be reported on Zions Bank Wire Transfer Agreement?

The information that must be reported includes the sender's name, contact details, bank account information, recipient's name and account details, transfer amount, and any additional instructions necessary for the transfer.

Fill out your Zions Bank Wire Transfer Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proof Wire Transfer Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.